Climate and environment at grenke

Our ambition in the climate and environment dimension is to accelerate the transition to a green economy by offering sustainable financial services and making it easier for SMEs to make environmentally conscious investment decisions. This includes in particular our strategic focus topics in the climate and environment dimension.

Climate protection and adaptation to climate change

GHG Emissions

By reducing our CO2 emissions (Scope 1, 2 and 3) and achieving climate neutrality, we want to make a contribution to climate protection and adaptation to climate change. In doing so, we want to help shape a sustainable future for all our stakeholders. This includes our SME customers, business partners, employees and investors alike.

In 2024, we further developed our climate targets, taking into account the recommendations of the Science Based Target Initiative and the science based approach of limiting global warming to 1.5 degrees Celsius. Our targets cover all relevant Scope 1, 2 and 3 activities in accordance with the Greenhouse Gas Protocol. Our base year 2022 serves as a reference year. For a complete base year, we supplemented the emissions data for 2022 with conservative projections. In this way, we take into account any incompleteness for which we gained new insights as part of the further developments in 2023 and 2024.

In the 2024 financial year, we further developed the calculation of our corporate carbon footprint (CCF). Our CO2 emissions were previously calculated using data from the previous year due to the time lag in the submission of utility bills. In the financial year, we improved the calculation of our corporate carbon footprint and now use the data from the respective financial year and close data gaps with the help of extrapolations.

Our Scope 1 emissions account for around 34% of our total emissions in 2024. (base year 2022: 36%) As part of the calculation of our CCF 2024, Scope 1 emissions amounted to around 2,690 tCO2e (base year 2022: 3,407 tCO2 e). At 2,495 tCO2e (base year 2022: 3,051 tCO2 e), the largest share of this resulted from our company fleet.

Our Scope 2 emissions account for around 12% of our total emissions. (base year 2022: 16 percent). According to the location-based method, Scope 2 emissions amounted to 960 tCO2e in 2024 (base year 2022: 1,498 tCO2e). The majority of these Scope 2 emissions are attributable to our electricity consumption at 607 tCO2e (base year 2022: 843 tCO2e).

Our Scope 3 emissions account for around 53% of our total emissions. (base year 2022: 48%) They amounted to 4,183 tCO2e in 2024 (base year 2022: 4,632 tCO2e). None of the Scope 3 figures currently include any information on emissions from our leased assets. We will report any changes in the shares of the total footprint in subsequent years in a transparent manner.

Overall, we were able to reduce our total emissions (Scope 1, 2 and 3) to 7,833 t CO2e (base year 2022: 9,537 t CO2e), which corresponds to a reduction of 18% compared to the base year.

Decarbonisation

Resilience & scenario analysis

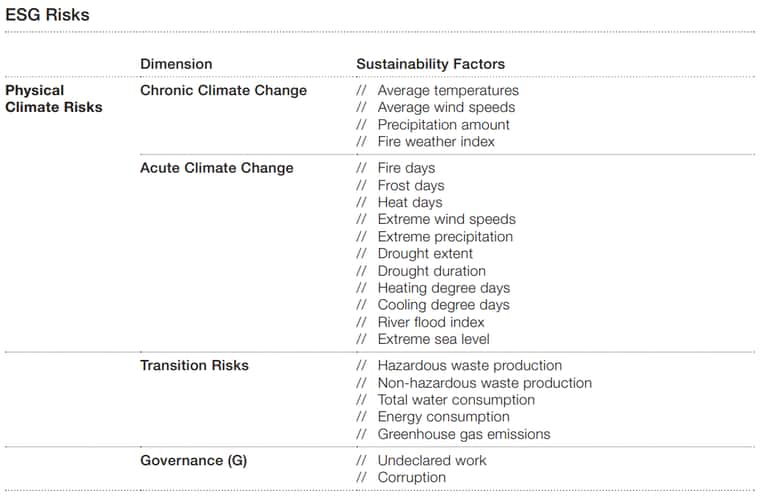

The sustainable transformation of the economy and the challenges of climate change present financial service providers with new and complex risks. At the same time, they open up opportunities to strengthen the resilience of financial systems. We are analyzing the impact of global developments on the resilience of our business model as part of a scenario analysis to examine how robust our business model, our operational processes and our loan portfolio are against the dynamic requirements of global climate and sustainability goals.

Our scenario analysis is based on scientifically sound assumptions, including the scenarios of the Intergovernmental Panel on Climate Change (IPCC) and the Network for Greening the Financial System (NGFS). Developments examined include, for example, a possible rise in the global carbon price, increasing weather extremes or regulatory changes, as well as their impact on risk positions.

Overall, our scenario analysis revealed low risks for our business. This is in particular due to the high diversification of our portfolio across our 31 countries, the large number of individual small-ticket financings with SME customers from a wide range of sectors and our broadly diversified property portfolio.

The increase in physical and transitory risks may increase the potential default risk of certain borrowers. Mining and quarrying", "Energy supply", "Water supply; sewage and waste disposal and remediation of environmental pollution" and "Transportation and storage" were identified as particularly risk-exposed sectors. These sectors accounted for just 4.29% of the leasing business in 2024, measured on the basis of all current leasing contracts (2023: 4.26%). In line with this low share, the potential risk can be assessed as very low.

ESG-Risks

ESG Products and Services

ESG Products and Services

Our focus is on financing solutions tailored to small and medium-sized enterprises and their investment needs. By financing green economy assets, we contribute to the sustainable transformation of our customers' business activities individually and of the economy as a whole.

Green Economy Objects

We want to support the transformation to a green future with our range of sustainable financial services and make it easier for our customers to make environmentally conscious investment decisions. The acquisition of new technologies requires the use of raw materials and natural resources. Without appropriate measures, this can lead to significant waste production, which would have a strong negative impact on our environment. Our aim is to steadily increase the proportion of green economy assets in our new leasing business and thus finance the sustainable investment needs of our SME customers. These investment needs include lease objects for the generation and storage of renewable energies. The development of local green economy expertise and partner networks enables effective risk management and the utilization of growth opportunities. In the 2024 financial year, this enabled the share of green economy properties in the Group-wide leasing new business, measured in terms of net acquisition volume, to be increased to 7.8% (2023: 7.7%). ebikes continue to be particularly relevant in the green economy segment, accounting for 4.3% of the Group's new leasing business in 2024 (2023: 4.3%). The share of green economy objects in our new leasing business in the 2024 financial year corresponds to a net acquisition volume of EUR 238 million (2023: EUR 200 million). The share of medical objects in our overall portfolio increased slightly across the Group to 8.5% in 2024 (2023: 8.0%).

Green-Economy-Objects Portfolio

Green-Economy-Objects New Business Volume

grenke Sustainability Index (GSI)

Digitisation and resource conservation

Digitisation

Digitisation

Minimize and drive digitisation

As a provider of small-ticket lease financing, our business model traditionally involves a high volume of documents and paperwork. As part of our sustainability strategy, we are pursuing the automation of our core leasing processes. We are working to reduce paper consumption in our paper-intensive processes to a minimum.

Digital personnel file

With the digital personnel file, we enable our employees to access personnel documents from anywhere and at any time. At the same time, we ensure legally compliant handling of deletion and retention periods. The digital personnel file also makes it possible to process and manage important formalities such as payslips or vacation requests in paperless form.

Digital customer portal

Our digital customer portal makes it possible to manage contracts, invoices and data online at any time. In the 2024 financial year, the portal was available in 27 countries, and there are plans to introduce it in other countries. Invoices are largely sent in paperless form. Invoices are already sent digitally in 26 countries.

eSignature

Since 2015, documents can be sent electronically and legally signed at grenke. The eSignature simplifies the conclusion of financing agreements, saves paper and mailing and was used in 27 countries in 2024. The electronic signature is also used within the Group, for example when signing minutes or contracts between companies.

grenke AI challenge

Artificial Intelligence (AI) is also a high priority at grenke and will become even more important in the coming years. This year's AI challenge kicked things off by inviting all employees worldwide to submit specific AI use cases aimed at improving day-to-day work. The active involvement of our employees was a key aspect of our efforts to promote innovation from within our own ranks. The use cases submitted were evaluated and analyzed in the 2024 financial year. The first ideas are already being prepared for implementation.

Resource conservation

New Work Concept

We try to use our spaces both efficiently and in a way that conserves resources. This is our response to the changes in the working world (New Work) brought about by digitalization. Additionally, we would also like to make our workplaces more attractive for our employees. In doing so, we ensure that we adapt our building and space design to the changing environmental and climate conditions and continue to reduce our consumption of resources. The building of our Italian subsidiary De Castillia 23" in Milan has served as a model since 2022 and the Melbourne site since 2023. In 2024, our teams in Hamburg and Frankfurt and grenke Bank moved into new premises redesigned according to the New Work principle. Further redesigns are also planned for 2025.

We are also working on obtaining an increasing proportion of the our electricity supply from renewable energy sources. At our site in Baden-Baden, we have been operating a photovoltaic system with a maximum output of 165 kWp since 2022. By using the electricity we generate ourselves, we have the potential to save around 1.4 million kg of CO2 over a 20-year period.

Energy consumption

One of the biggest drivers of our CO2 emissions to date is energy consumption. We are continuously working on reducing the energy consumption of our locations and making them more efficient. To achieve our climate targets, we are constantly modernizing our own buildings and upgrading them to the latest energy standards. The company buildings we rent in Germany always have an energy certificate. At the same time, we regularly commission energy audits in Germany to determine the company's energy efficiency and, if necessary, introduce measures to increase efficiency. In the 2021 financial year, energy audits in accordance with DIN EN 16247 were carried out by TÜV SÜD at our headquarters in Baden-Baden and at other branches in Germany.

In 2024, we continued to pursue the goal of sourcing electricity from renewable or emission-free energy sources at all our locations. A corresponding decision was mde by the board. With the exception of a few branches, we purchase electricity at our locations ourselves and are pursuing the switch to sustainable tariffs at the earliest possible date.

Subsequent transportation of our objects

In a few cases, we take back the rented properties ourselves at the end of the contract, as the customer does not take them over and they are not returned to a dealer. If possible, we sell them on. At that point, we organize transport to get the items either from the customer to us or from us to the buyer. We want to make these transports climate-neutral and therefore work with climate-neutral products such as DHL GoGreen.

We build sustainable purchasing partnerships for goods and services purchased for our day-to-day business and ensure that our decommissioned IT equipment goes through a second life cycle."

Circular economy

Circular economy

At the end of the term, the vast majority of all leased items are returned to our specialist retail partners. Only a small proportion of the assets are returned to us. In our main markets of Germany, France and Italy, we have our own asset brokers to resell these items. These brokers take over the leased assets at the end of the term, check their functionality and, where possible, return them to the economic cycle via the secondary market. In the 2024 financial year, we took back 23,889 objects in our core markets of Germany, France and Italy through our grenke asset brokers. Furthermore, we are reducing our impact on the environment by improving our take-back processes, using packaging to avoid waste and working more closely with emission-free shipping partners and transport service providers. This includes the further development of our own recycling platforms as well as potential partnerships and the design of our financing products.

EU-Taxonomy

EU-Taxonomy

Information in accordance with Article 8 of the EU Taxonomy Regulation (2020/852)

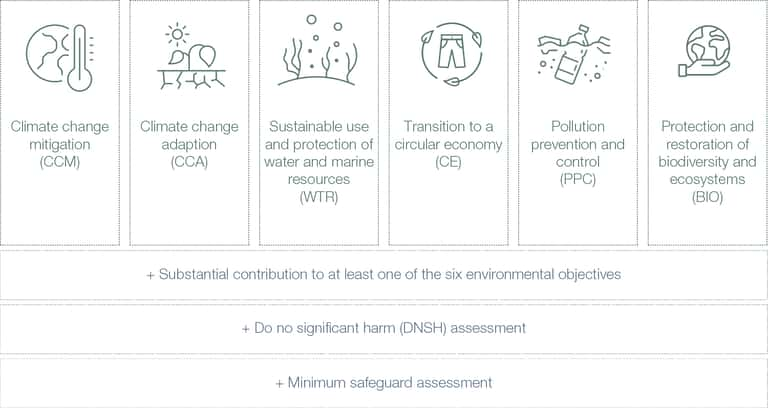

With the EU Taxonomy (EU Regulation 2020/852), the European Commission prescribes uniform disclosure of sustainability-related key performance indicators throughout the EU as part of non-financial reporting. The taxonomy conformity check is carried out in a two-stage process. In the first step, the leasing activity identified as taxonomy-compliant is analyzed for its material contribution to one of the environmental objectives. In the second step, this activity is checked to ensure that it does not significantly impair the achievement of the other environmental objectives. If both test steps have been carried out successfully and if grenke AG complies with the minimum protection described above, the leasing activity is classified as taxonomy-compliant.

Targets of EU-Taxonomy