Please note that this website shows an excerpt from the grenke AG Annual Report 2024. The annual report, which is also available in the “Reports & Presentations” section of the grenke AG website, prevails.

Our Board of Directors

Interview Dr Sebastian Hirsch, Chief Executive Officer

Our Supervisory Board

Report of the Supervisory Board

Jens Rönnberg, Chair of the Supervisory Board

grenke Management

Learn more about the Board of Directors and the Supervisory Board.

Group key figures new business

Unit

2024

2023

Change (%)

Leasing new business

EURk

3,057,009

2,581,265

18.4

DACH

EURk

705,075

625,301

12.8

Western Europe (without DACH)

EURk

784,413

683,534

14.8

Southern Europe

EURk

731,992

595,681

22.9

Northern/Eastern Europe

EURk

640,758

524,736

22.1

Other regions

EURk

194,771

152,013

28.1

Contributions margin 2 (CM2) on new business leasing

EURk

518,506

426,312

21.6

DACH

EURk

95,158

80,861

17.7

Western Europe (without DACH)

EURk

139,776

117,428

19.0

Southern Europe

EURk

123,799

102,470

20.8

Northern/Eastern Europe

EURk

117,578

93,691

25.5

Other regions

EURk

42,195

31,862

32.4

Further information Leasing

Number of new contracts

Units

315,901

291,689

8.3

Mean acquisition value

EUR

9,677

8,849

9.4

Mean term of contract

Months

49

49

0.0

Further information Leasing portfolio

Volume of leased assets per end of period

EURk

10,118,915

9,414,817

7.5

Number of current contracts per end of period

Units

1,093,499

1,048,868

4.3

New business factoring

EURk

910,417

838,558

8.6

DACH

EURk

297,121

295,554

0.5

Southern Europe

EURk

236,179

183,024

29.0

Northern/Eastern Europe

EURk

377,116

359,979

4.8

grenke Bank

SME lending new business incl. microcredit business

EURk

37,768

45,021

– 16.1

Regions Leasing

DACH: Germany, Austria, Switzerland

Western Europe (without DACH): Belgium, France, Luxembourg, the Netherlands

Southern Europe: Italy, Croatia, Malta, Portugal, Slovenia, Spain

Northern/Eastern Europe: Denmark, Finland, UK, Ireland, Latvia, Norway, Poland, Romania, Sweden, Slovakia, Czechia, Hungary

Other regions: Australia, Brazil, Chile, Canada, Turkey, USA, UAE

Regions Factoring

DACH: Germany, Switzerland

Southern Europe: Italy, Portugal

Northern/Eastern Europe: UK, Ireland, Poland, Hungary

Consolidated franchise companies

Leasing: Chile, Canada (3 x), Latvia

Group key figures income statement

Unit

2024

2023

Change (%)

Income Statement

Interest and similar income from financing business

EURk

574,348

467,412

22.9

Expenses from interest on refinancing including deposit business

EURk

217,611

128,879

68.8

Settlement of claims and risk provision

EURk

131,012

90,829

44.2

Operating expenses

EURk

341,019

308,940

10.4

Operating result

EURk

90,015

112,914

– 20.3

Group earnings before taxes

EURk

89,402

110,403

– 19.0

Group earnings

EURk

70,158

86,714

– 19.1

Group earnings attributable to ordinary shareholders

EURk

65,446

83,248

– 21.4

Group earnings attributable to hybrid capital holders

EURk

10,498

9,068

15.8

Group earnings attributable to non-controlling interests

EURk

– 5,786

– 5,602

– 3.3

Earnings per share (basic and diluted)

EUR

1.44

1.79

– 19.6

Return on equity before tax

Percent

6.7

8.2

-1,5 pp

Cost-income ratio

Percent

59.2

59.1

0,1 pp

Staff cost

EURk

198,209

176,007

12.6

of which total remuneration

EURk

162,593

144,468

12.5

of which fixed remuneration

EURk

139,140

126,009

10.4

of which variable remuneration

EURk

23,453

18,459

27.1

Average number of employees in full-time equivalents (FTEs)

Employees

2,196

2,068

6.2

Group key figures consolidated statement of financial position

Unit

Dec. 31, 2024

Dec. 31, 2023

Change (%)

Statement of Financial Position

Total assets

EURm

8,219

7,100

15.8

Lease receivables

EURm

6,516

5,700

14.3

deposit volume grenke Bank

EURm

2,229

1,617

37.8

Equity persuant to statement of financial position*

EURm

1,323

1,355

– 2.4

Equity persuant to CRR

EURm

1,168

1,182

– 1.2

Equity ratio

Percent

16.1

19.1

-3.0 pp

Embedded value, leasing contract portfolio (excl. equity before taxes)

EURm

560

484

15.7

Embedded value, leasing contract portfolio (incl. equity after taxes)

EURm

1,719

1,689

1.8

* Including AT1 bonds (hybrid capital), which are reported as equity under IFRS.

The grenke share

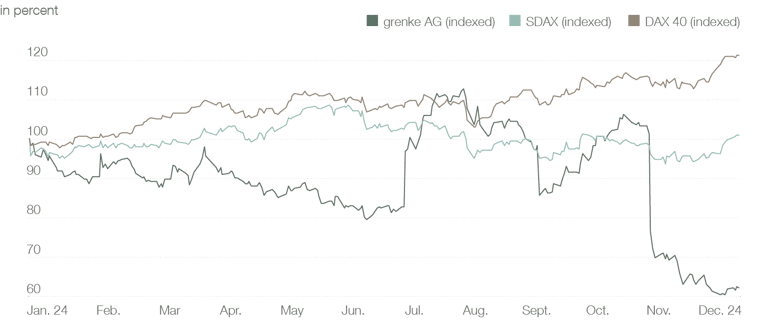

Performance of the grenke share and indices (January 1 to December 31, 2024)

In 2024, grenke AG’s share price remained volatile amid a challenging capital market environment. The stock opened at EUR 25.30 on January 2, 2024, initially declining slightly to EUR 24.40 on February 6, 2024. On that day, we announced the approval from the German Federal Financial Supervisory Authority (BaFin) for our planned share buyback programme, allowing us to repurchase shares of up to EUR 70 million. Following a temporary dip, the stock rebounded after the release of our full-year financial results on March 7, 2024, reaching EUR 24.80 on March 27, 2024. It then declined again, hitting a temporary low of EUR 20.15 on June 14, 2024. However, the publication of new business figures for the second quarter on July 3, 2024, sparked an upward trend, peaking at the year’s high of EUR 28.55 on July 31, 2024. Due to the unfortunate coincidence of the announcement of Isabel Rösler’s departure from the Board of Directors at the end of the 2024 financial year and a BaFin notification on ensuring proper corporate governance at grenke Bank, the share price fell to EUR 21.70 on September 6, 2024. After a subsequent recovery to EUR 26.90 on October 17, 2024, the Board of Directors issued an ad hoc statement on October 29, 2024 announcing an adjustment to the Group earnings forecast to EUR 68 to 76 million, from the previous range of EUR 95 to 115 million. As a result, the stock declined until the end of the financial year, reaching a low for the year of EUR 15.04 on December 19, 2024, and closing at EUR 15.42 on December 30, 2024. This amounted to a 39 percent decline over the course of 2024. With a total of 46,495,573 registered shares, the market capitalisation of grenke AG equalled EUR 717 million as of December 31, 2024. As of December 31, 2024, the embedded value (net asset value) amounted to EUR 1,719 million. It encompasses the equity, as well as the present value of expected future cash flows from the existing business, serving as an economic benchmark for valuation. Based on this amount, the net asset value per share equals EUR 38.91.

Trading volume for the grenke share (January 1 to December 31, 2024)

In 2024, the average daily trading volume in grenke shares on Xetra was 76,523 shares. The highest single-day trading volume occurred on October 30, 2024, following our ad hoc statement announcing the Group earnings forecast adjustment, with 1,271,161 shares traded. Another trading peak was recorded on September 6, 2024, with 726,688 shares, the day when the announcement of Isabel Rösler’s resignation from the Board of Directors coincided with BaFin’s disclosure regarding grenke Bank. The lowest single-day trading volume was 9,145 shares on January 18, 2024. Over the full year, the total trading volume in grenke shares on Xetra reached approximately 19.4 million shares.

Share data

Unit

2024

2023

2022

Closing price on last day of fiscal year

EUR

15.42

25.05

19.58

Highest share price

EUR

28.55

32.45

33.32

Lowest share price

EUR

15.04

19.28

17.99

Market capitalisation

EURm

717

1,165

910

Embedded Value

EURm

1,719

1,689

1,664

Embedded Value per share*

EUR

38.91

36.33

35.79

Earnings per share

EUR

1.44

1.79

1.75

Dividend per share**

EUR

0.40

0.47

0.45

Dividend yield**

Percent

2.59

1.88

2.30

Price-Earnings Ratio

10.71

13.99

11.19

Share prices based on XETRA closing prices.

* 2024: Relative to the 44,177,878 shares entitled to liquidation as of December 31, 2024.

** 2024: Proposal to the Annual General Meeting

Fundamentals of our share

Get all information about the grenke share here.

Shareholder structure (Share in percent)

About the shareholder structure

* General partner: Grenke Vermögensverwaltung GmbH

Limited partners: The Grenke Family (Wolfgang, Anneliese, Moritz, Roland, Oliver Grenke)

Grenke Beteiligung GmbH & Co. KG and grenke AG have entered into a prophylactic control termination agreement. You can view its content here.

The above information is not guaranteed and based on the voting right notifications received by the Company in accordance with the German Securities Trading Act (WPHG).

As a family-owned company with strong medium-sized business roots, we have a major shareholder in Grenke Beteiligung GmbH & Co. KG, which is owned by Anneliese Grenke, Company founder Wolfgang Grenke, and their three adult sons, Moritz, Roland, and Oliver Grenke. As of December 31, 2024, Grenke Beteiligung GmbH & Co. KG held 40.84 percent of the Company’s shares, while the GRENKE Foundation owned 3.03 percent. Following the completion of the share buyback programme on September 30, 2024, grenke AG held 4.98 percent of its own shares. Other shareholders who, as of the respective publication date of their voting rights notification, held more than 3 percent of the shares were: ACATIS Investment Kapitalverwaltungsgesellschaft mbH (5.02 percent); GANÉ Investment AG with segregated sub-fund assets (3.04 percent); and Universal Investment Gesellschaft mbH (5.03 percent). The free float, as defined by Section 5.7.2 of the current DAX Equity Index Methodology Guide, amounted to 59.16 percent. The shareholding of the Board of Directors and Supervisory Board as of the reporting date was approximately 0.2 percent. The individual shareholdings of the members of the Board of Directors and Supervisory Board can be found in the table in Chapter 8.6 Shareholdings of the Board of Directors and Supervisory Board, contained in the Corporate Governance Statement.

Our analyst ratings

How do analysts rate the grenke share? Find out here.

Share buyback program

In February 2024, grenke AG successfully completed its share buyback program. Over the past 33 weeks, the company has bought back a total of 2,317,695 shares at an average price of EUR 23.92 per share, which corresponds to 4.98% of the outstanding capital.

Our dividend policy

A key element of our growth strategy is a reliable dividend policy. For years now, the payout ratio has been around 25% of Group earnings.

Dividend in EUR

On April 30, 2024, grenke AG held its ordinary Annual General Meeting as an in-person event, as in the previous year. A total of 33,672,724 votes, including absentee votes, were represented, accounting for 72.4 percent of the Company’s share capital. Shareholders approved the proposal by the Supervisory Board and Board of Directors to distribute a dividend of EUR 0.47, amounting to a total payout of EUR 21.9 million and a payout ratio of 24.9 percent of Group earnings. For years, grenke AG has maintained a stable dividend policy, aiming to distribute approximately one-quarter of Group earnings. For the 2024 financial year, the Supervisory Board and Board of Directors are proposing a dividend of EUR 0.40 per share, representing a payout ratio of 25 percent.

The Deputy Chair of the Supervisory Board, Dr Konstantin Mettenheimer, left the Board at the end of the Annual General Meeting as scheduled. Manfred Piontke was elected as a new member of the Supervisory Board for a term of three years. Following the Annual General Meeting, the Supervisory Board elected Moritz Grenke as its Deputy Chair during its meeting. More details on the composition of the Supervisory Board can be found in Chapter 8.2.2 Supervisory Board, in the Corporate Governance Statement.