Please note that this website shows an excerpt from the grenke AG Annual Report 2024. The annual report, which is also available in the “Reports & Presentations” section of the grenke AG website, prevails.

ESRS 2 – Company profile

Regulatory framework

This Group non-financial statement of grenke AG (hereinafter referred to as the non-financial reporting) is a legal requirement in accordance with Section 315b (1) HGB and Section 315c HGB, as well as the provisions of Article 8 of the EU Regulation 2020/852 (EU Taxonomy) and the associated delegated acts. The Group non-financial statement is part of the Group Management Report for the reporting period from January 1, 2024, to December 31, 2024. The reporting date for all sustainability information mentioned in the report is December 31, 2024.

In the 2024 financial year, we continued to develop our non-financial reporting in preparation for the application of EU Directive 2022/2464, the Corporate Sustainability Reporting Directive (CSRD), and the application of Delegated Regulation (EU) 2023/2772 supplementing Directive 2013/34/EU (NFRD), the European Sustainability Reporting Standards (ESRS). In the case of the mandatory application of the CSRD, the selection of the auditor for the non-financial reporting is made by the Annual General Meeting. Accordingly, our Annual General Meeting in 2024 decided to appoint BDO AG Wirtschaftsprüfungsgesellschaft, Hamburg, as the auditor of the mandatory CSRD reporting to obtain limited assurance.

Due to the fact that the CSRD has not yet been transposed into German law as of December 31, 2024, grenke AG is not required to apply the CSRD or ESRS for the 2024 financial year. As in previous years, the requirements for the non-financial reporting result from the legal framework created by the CSR-RUG. As a company with a reporting obligation, within this legal framework we are permitted to use European frameworks Due to their incorporation into EU law, the ESRS are considered generally recognized frameworks., among others, to prepare the non-financial reporting. Due to its adoption into EU law, the ESRS is to be regarded as a generally recognised framework provided the reporting obligations under commercial law pursuant to Sections 315b and 315c HGB have been met.

In preparation for the future mandatory application of the CSRD, we have decided to voluntarily prepare the 2024 non-financial reporting with partial application of the first set of ESRS and in accordance with the requirements of the HGB in the form of the CSR-RUG. At this time, we are refraining from estimating Scope 3 emissions in Category 13 (leased assets) according to the GHG Protocol. From our perspective, the current availability of data does not allow for a reliable estimate of the Scope 3 emissions figure for the portfolio of leased assets. In 2025, we will take further measures, such as collecting primary data from manufacturers and conducting ESRS-compliant estimates, to include this information in future reports and fully report in accordance with ESRS.

We have also decided to voluntarily subject our non-financial reporting to a limited assurance review by our auditor, BDO AG Wirtschaftsprüfungsgesellschaft.

The partial application of the ESRS as of 2024 replaces the reporting standards of the Global Reporting Initiative (GRI SRS) used in the 2022 and 2023 reporting years.

General principles for preparation

BP-1, BP-2:

Information related to specific circumstances

Consolidation

Unless otherwise stated, the following information relates to the grenke Group; the non-financial information takes into account the companies included in the IFRS-compliant scope of consolidation. The same applies to the disclosures on the EU Taxonomy (see Chapter 3.3.1 Disclosures in accordance with Article 8 of the EU Taxonomy for details).

Methodology

In this non-financial reporting, we provide information on the development status of our sustainability strategy, as well as the related management approaches, governance structures, key measures, and progress made during the fiscal year along our upstream and downstream value chain (see Chapter 1 Group fundamentals under Business model analysis). No secondary data from indirect sources or sector data is used for these sections. Data gaps in our GHG emissions and consumption figures were closed through extrapolations. The non-financial reporting may also include information related to intellectual property or the results of innovations.

We assess our sustainability-related impacts, risks, and opportunities over short-term (up to one year), medium-term (one to five years), and long-term (more than five years) horizons. We adhere to the principles underlying the ESRS in this report: relevance, faithful representation, comparability, verifiability, understandability, materiality, and stakeholder engagement.

Our double materiality assessment (DMA), updated in the reporting year, forms the basis for the selection of five of ten specific ESRS topic standards E1 Climate protection and climate adaptation, E5 Circular economy, S1 Own workforce, S4 Consumers and end-users and G1 Business conduct (see the chapter ESRS 2 Sustainability strategy – Double materiality assessment and the list of specific standard requirements in Chapter 3.6 Appendices).

Phase-in

We describe the use of phase-in regulations for data requirements that we partially or fully do not yet meet in the index tables for the individual topic standards (see Chapter 3.6 Appendices).

Partial application of ESRS

We measure our Scope 1, 2, and 3 greenhouse gas emissions based on the Greenhouse Gas Protocol (see chapter ESRS E1 Climate change mitigation and adaptation – Targets). In addition to the information provided in this report, we are continuously improving our measurement methods. Gathering emissions data from our value chain is particularly challenging: grenke specialises in small-ticket leasing for small and medium-sized customers. In this segment, we work with over 39,000 specialist reseller partners worldwide, spread across 31 countries. Our leasing portfolio is highly diversified, comprising over 300 types of objects and thousands of manufacturers. Emissions data for our leased assets depend not only on manufacturing details but also heavily on the specific usage behaviour of our lessees.

These unique aspects of our business model make calculations based on primary data practically impossible. Our previous attempts to derive estimates using external data sources have also shown that secondary data is currently only available in fragmented form for accurate calculations or estimates. At this point in time, and despite reasonable efforts, we have not achieved sufficient data coverage to provide reliable estimates for Scope 3 emissions from our leased assets. We expect data availability to expand and improve in the coming years. To enable disclosure in future reporting years, we will implement additional measures in 2025 to establish more reliable estimation methodologies, for example, integrating different external databases to aggregate average data for our key asset categories.

References to other EU legislation

In the index of this non-financial reporting (see Chapter 3.6 Appendices), we also provide references to further data resulting from other EU legislation in accordance with ESRS 2 Appendix B. These include the Sustainable Finance Disclosure Regulation (SFDR), Pillar 3, Benchmark Regulation and the European Climate Law.

Information relating to special circumstances

We continued to develop our non-financial reporting in 2024 to comply with the structure required by the ESRS. Further adjustments have been based on the results of our updated materiality analysis, particularly the analysis of our sustainability-related impacts, risks and opportunities (IRO) along our entire value chain (see ESRS 2 Sustainability strategy – Double materiality assessment). We specifically highlight any changes to calculation methods and prior-year figures in the respective chapter.

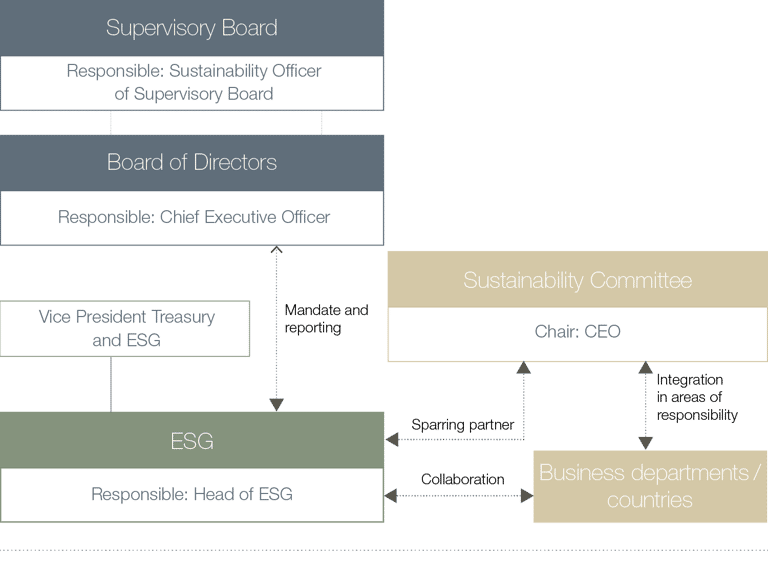

ESG organisation and management

We ensure responsible corporate behaviour by embedding sustainability in our organisation and governance.

GOV-1:

The role of the administrative, management and supervisory bodies

Board of Directors and Supervisory Board

As a stock corporation under German law, grenke AG has a Board of Directors, Supervisory Board and Annual General Meeting. The Board of Directors is responsible for managing the Company. It is monitored and advised by the Supervisory Board. Our commitment to sustainability is an integral component of our business strategy. Responsibility for sustainability lies with our CEO Dr Sebastian Hirsch. We continued to develop and update our sustainability strategy in the 2024 financial year. The strategy’s implementation was also accompanied by regular reports to the full Board of Directors in the 2024 financial year. The topics discussed at the meetings included, among others, the implementation and results of the IRO analysis, the further development and management of the sustainability strategy, and the achievement of its objectives.

Since 2022, Dr Mitic, as the Sustainability Officer, has been responsible for sustainability within the Supervisory Board. As an expert in sustainable corporate development, she supports and monitors the ESG transformation of the grenke Group (see the information on the competence assessment of Supervisory Board members in the Report of the Supervisory Board).

Audit Committee

The Audit Committee (PrüfA) is responsible for auditing and monitoring the non-financial reporting in accordance with the requirements of the CSRD.

For information on the personnel changes in the Board of Directors and Supervisory Board, see Chapter 4 Changes in the Company’s governing bodies, where we explain in detail the number of members of the Board of Directors and Supervisory Board and their competences. The competence and efficiency review conducted in 2024 in accordance with Section 25d (11) nos. 3 and 4 KWG did not identify any conflicts of interest among members of the Board of Directors and Supervisory Board other than those previously disclosed to the Chair of the Supervisory Board (see Report of the Supervisory Board).

ESG area

The operational management of the sustainability strategy is the responsibility of the ESG department at grenke. This includes both the continued development of the strategic direction and the coordination of Group-wide ESG-related activities. The Head of ESG reports to the VP Treasury and ESG.

Sustainability Committee

The Sustainability Committee serves as a driving force for the integration of sustainability issues into the material subject areas. The ten-member committee comprises the areas of ESG, Refinancing, Human Resources, Purchasing and Portfolio Management, Sales, Risk Management, Accounting and Taxes, as well as Investor Relations. It also includes the Sustainability Officer on the Supervisory Board and the CEO, who also chairs the Committee.

At its quarterly meetings, the Committee discusses relevant issues relating to the implementation of the sustainability strategy and the impact on the risk management process.

ESG organisation chart

GOV-2:

Provision of information for corporate bodies and sustainability-related topics

The Head of ESG reports to the full Board of Directors as part of quarterly updates on important progress. In preparation for the non-financial reporting, a report was also submitted to the Audit Committee in 2024.

GOV-2, 26c)

List of material impacts, risks and opportunities addressed by the Board of Directors and Supervisory Board

As part of the IRO analysis, the Board of Directors, the Vice Presidents as the first management level below the Board of Directors, and the Sustainability Committee analysed the material impacts, risks and opportunities in relation to our business model and to people and the environment (see ESRS 2 – Sustainability strategy – Description of the process for identifying and assessing material impacts, risks and opportunities, as well as the tables with IRO results).

GOV-3:

Integration of sustainability-related benefits into incentive systems

In addition to the organisational anchoring, we underline the high relevance of the topic of ESG by linking top management remuneration to the achievement of sustainability targets. We measure the proportion of top management positions with a sustainability component in variable remuneration as a TOP KPI (see Chapter 1. Group fundamentals in the management report under 1.3.3 Non-financial performance indicators). Since the 2022 financial year, variable remuneration components for the entire Group Board of Directors have been linked to sustainability targets. This results in a quota of 100 percent for the Board of Directors for all three financial years. Climate-related components have not yet been included in these remuneration elements. Since his appointment as General Representative on March 1, 2023, the sustainability targets have also been applied to Dr Martin Paal, who has been serving as CFO since July 1, 2024. In 2024, the ratio for the overall assessment of the Board of Directors and top management was 1.69 percent (2023: 1.8 percent) and thus remained relatively stable compared to the previous year. We will maintain this in 2025 as well.

For the first management level below the Board of Directors (Vice Presidents), we will also take sustainability-related factors into account in the variable remuneration as of January 1, 2025. For further details on remuneration, please refer to our remuneration report (see remuneration report), which is also available on our website.

GOV-4:

Declaration on due diligence

(Sustainability due diligence)

A complete table on the due diligence declaration, ESRS GOV-4, AR 10 can be found at the end of this report in Chapter 3.6 Appendices.

Sustainable corporate governance

Policies and frameworks

We base our sustainability strategy and activities on internationally recognised frameworks and standards as well as on policies we have implemented ourselves and integrate these into our business activities. The following lists some of the most important guidelines and principles:

International frameworks and standards

UN Sustainable Development Goals

We take responsibility for sustainable development across all of our business activities and have integrated the United Nations Sustainable Development Goals (SDGs) into our sustainability strategy (see chapter ESRS 2 Sustainability strategy – Strategic goals and areas of action).

Diversity Charter

Equal opportunity and diversity are fundamental components of our corporate culture. In the 2022 financial year, we signed the Diversity Charter and are actively committed to further anchoring the concept of diversity in our organisational structure. We are also committed to a corporate culture characterised by mutual respect and appreciation and align our HR processes to appropriately honour the diverse skills of our employees. We recognise diversity within and outside our company and use the associated potential to further develop our company.

German Corporate Governance Code

grenke AG fulfils the main legal requirements for the management and supervision of listed companies set out in the German Corporate Governance Code (GCGC) and, as far as possible, the standards for good and responsible corporate governance recommended by the GCGC (see Chapter 8. Corporate Governance Statement – Corporate Governance Report). We were recognised for our efforts in this area in 2024 by being awarded first place among the companies in the SDAXs (2023: third place).

Due diligence processes and supporting measures

Guidelines and voluntary commitments

grenke Code of Conduct

We have set out the basis for our compliance and grenke-compliant behaviour in our Code of Conduct. These are available to download from our website. The Code of Conduct is the binding guideline for our values and our behaviour. It is binding for all people working at grenke. This means for the Board of Directors, the Supervisory Board, the management of our subsidiaries, managers and every employee. In order to offer this broad target group clear and simple instructions for action, the Code of Conduct summarises the rules and regulations that are important for our Group in a low-threshold manner. With the published Code of Conduct, we also reaffirm to the outside world that we conduct our business activities in accordance with the relevant national legal standards, key international legal standards, conventions and declarations, such as the International Bill of Human Rights, the core labour standards of the International Labour Organization (ILO) and the UN Guiding Principles on Business and Human Rights (UN Global Compact), but also on the basis of firm ethical values and principles such as integrity, credibility and reliability. In the individual chapters that follow, we also address the use of the grenke Code of Conduct in the various work and subject areas (see the chapters ESRS S1 Own workforce, ESRS S4 Consumers and end-users, and ESRS G1 Business conduct).

grenke Supplier Code of Conduct

For us, transparency and trust are the basis of good cooperation. We also expect our suppliers to comply with our Code of Conduct by implementing similar standards for themselves and their suppliers and subcontractors. Among other things, our Supplier Code of Conduct requires our suppliers to comply with labour and human rights as well as environmental protection laws (see the chapters ESRS S4 Consumers and end-users and ESRS G1 Business conduct); these are also available to download from our website.

Environmental Policy

The Environmental Policy summarises our efforts in environmental protection. We are committed to continuously improving our environmental management system in line with regulatory and compliance obligations. This includes ensuring that we fulfil the requirements of environmental law and customary market standards. It is also a guideline for the implementation of measures and strategic fields of action to minimise our own corporate footprint and to support SMEs in making sustainable investments. We discuss these measures in detail in the following chapters. These policies are available to download on our website.

Travel guideline (Travel Policy) and

vehicle fleet guideline (Car Policy)

Our employees’ selection and use of different means of transportation (car, train, airplane) and the associated reduction in CO2 emissions are covered in both our Travel Policy and Car Policy. These policies support our CO2 emission reduction targets outlined in our Climate Action Plan. We also highlight the related measures separately in the relevant section of this non-financial reporting (see ESRS E1 Climate change mitigation and adaptation – Actions regarding the Company fleet and employee business travel).

Organisational Health and Security Policy (OHS Policy)

The aim of this guideline, which applies to all grenke companies in Germany, is to maintain, improve and promote the health and safety of our employees through efficient and systematic occupational health and safety. This is further supplemented by company health support measures. This policy is available to download from our website.

MDR-P:

Operationalising of the sustainability strategy and integration into the business organisation

We take appropriate initiatives, measures and concepts to operationalise the sustainability strategy and integrate it into the business organisation and processes.

Enterprise portfolio management

Company-wide project portfolio management controls the recording, monitoring and prioritisation of projects within the Company. When recording new projects, we also analyse their relevance to our material sustainability topics. In the 2024 financial year, our Company-wide project portfolio comprised 163 ESG-related projects. A total of 108 of these projects are related to the material topic “Digitalisation and resource conservation.” A total of 23 ESG-related projects were completed in 2024.

GOV-5:

Risk management and internal controls over sustainability reporting

The financial sector has a key role to play in achieving the European Sustainable Development Goals. Financial institutions are obliged to support the financing of the sustainability transformation. As part of this transformation, financial institutions may also be exposed to physical and transitory risks that need to be identified, assessed and managed. The risk management requirements for largely grenke arise from the “Information sheet on dealing with sustainability risks” dated December 20, 2019 (amended on January 13, 2020) and from the Minimum Requirements for Risk Management (MaRisk). We describe the integration of ESG risks in risk management in the risk report contained in this Annual Report (see Chapter 5. Risk report).

Internal control system

We explain the key components of our internal control system in Chapter 5. Risk report and there in relation to the Group accounting process under 5.3.5 and, in relation to the Group, under 5.3.6. The controls within the scope of our non-financial reporting are based on clearly defined processes and responsibilities, as well as the documentation of procedures. The ESG department is responsible for preparing the non-financial reporting. More than 24 departments were involved in the preparation of the non-financial reporting in 2024.

With our “Easy Go ESG” format, we support ESG data management throughout the year through training and information events on disclosure requirements with the departments involved. The continuous dialogue on our material sustainability topics ensures the availability of the required ESG data.

ESRS 2 – Sustainability strategy

Strategic goals and areas of action

SBM-1:

Strategy, business model and value chain

We see our non-financial commitment as a key success factor for our future viability and performance, as well as our long-term strong positioning in the market. Sustainability has been an integral part of our corporate activities since our foundation more than four decades ago.

grenke’s business model makes it easier for SMEs to utilise the latest resource-saving technologies by offering a range of financing options. At the same time, our solutions ensure that the leased assets can continue to be used or optimally utilised after the contract expires.

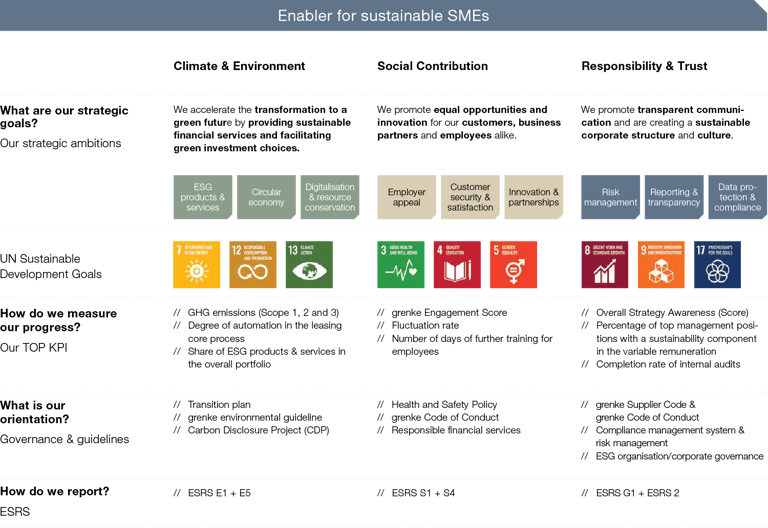

We have already embedded sustainability in our corporate strategy. Derived from this, our sustainability strategy describes our sustainability vision: To be a pioneer for sustainable SMEs.

MDR-A Actions and resources related to material sustainability aspects, MDR-T Tracking the effectiveness of strategies and measures through targets, MDR-P:

In line with this vision, our sustainability strategy sets out our ESG objectives and initiatives along the three dimensions of climate and environment, social contribution, and responsibility and trust. This covers our entire upstream and downstream value chain and the 31 countries in which grenke operates (grenke countries).

The grenke value chain includes all activities from refinancing and establishing relationships with our specialist trade partners to the entire core leasing process, as well as activities aimed at transitioning leased assets into a second lifecycle. Our value chain (see graphic “Value chain”) encompasses both upstream activities (1. Market research and product development; 2. Acquisition and support of specialist reseller partners (SRPs); 3. Acquisition of customers; 10. External financing and liquidity management) and downstream activities (7. Return of objects/recycling; 8. Continued use of objects – second lifecycle).

Further details on our business model, operations, segments, and the ownership structure of grenke AG can be found in Chapter 1. Group Fundamentals. Information on the cost structure and revenues of the business segments, in accordance with IFRS 8 disclosure requirements, is provided in Chapter 2. Economic report.

We have defined a strategic ambition for each dimension. We derived the strategic focus topics for our strategy from the analysis of our material topics. We base the design of our strategic ambitions on the United Nations Sustainable Development Goals (SDGs). Our sustainability strategy focuses on nine of the 17 goals of the 2030 Agenda of the United Nations. We monitor the objectives of our strategic areas of action using our nine TOP KPIs (see the chart grenke Sustainability strategy).

Value chain

Climate and environment

Our ambition in the climate and environment dimension is to accelerate the transition to a green economy by offering sustainable financial services and making it easier for SMEs to make environmentally conscious investment decisions. This ambition also particularly aligns with our strategic focus topics in the climate and environment dimension:

- ESG products and services – This topic describes our ability to enable SMEs to invest in their sustainability and to offer sustainable (leasing) financing and services ourselves (see chapter ESRS E1 Climate change mitigation and adaptation – Actions).

- Circular economy – This topic deals specifically with the reuse and recycling of leased objects at the end of the contract term to support a circular economy (see ESRS E5 Circular economy).

- Digitalisation and resource conservation – This topic describes our ability to digitalise processes and workflows, thereby minimising the use of resources (see ESRS E1 – Climate change mitigation and adaptation – Actions for a description of further actions).

Strategic areas of action: Climate & Environment

Strategic target

TOP KPI

Action

Reference in the report

Net zero by 2050

GHG emissions (Scope 1, 2 and 3)

Transition plan for decarbonisation;

Scope 1, 2 and 3 accounting

ESRS E1 – Climate change mitigation and climate change adaptation

Reduce paper-intensive processes and strengthen digitalisation

Degree of automation in the leasing core process

Reduction of paper-intensive processes through digital offerings such as eSignature, eContract, digital customer portal

ESRS E1 – Climate change mitigation and climate change adaptation

Increase share of green economy objects

Share of ESG products & services in the overall portfolio

Sustainable leasing contracts through objects that contribute to the sustainable transformation of our customers’ business

ESRS E1 – Climate change mitigation and climate change adaptation

Social contribution

We see our contribution to society in the promotion of equal opportunities and innovative strength for our SME customers, business partners and employees alike. This includes our strategic focus topics in the social contribution dimension:

- Employer attractiveness – This topic measures our ability to attract qualified employees and retain them with appropriate measures for promotion and personal development as well as target group-oriented offers (see ESRS S1 Own workforce).

- Customer safety and satisfaction – The focus here is on our ability to create targeted customer experiences and ensure a high level of customer satisfaction by offering SMEs attractive and equal access to financing. The two topics of customer safety and wellbeing and financial inclusion have been summarised in this topic due to their similarity (see ESRS S4 Consumers and end-users).

- Innovation and partnerships – This topic describes the development and maintenance of targeted partnerships as part of our commitment to promoting a sustainable society and innovative solutions (see ESRS S1 Own workforce).

Strategic areas of action: Social Contribution

Strategic target

TOP KPI

Action

Reference in the report

Increase employee satisfaction and women’s representation and diversity

grenke Engagement-Score

Annual survey of our employees on the topics of commitment and identification, loyalty and overall satisfaction with the company

Chapter ESRS S1 – Own workforce

Increase employee loyalty

Fluctuation rate

Indicator of sustainable HR management and employer attractiveness, offers to grow employee loyalty (see House of Benefits)

Chapter ESRS S1 – Own workforce

Promote and develop talent

Number of days of employee further training

Expansion and improvement of qualified training programmes (see House of Benefits - Development)

Chapter ESRS S1 – Own workforce

Responsibility and trust

We have summarised our striving for a sustainable corporate structure and transparent, reliable and trustworthy corporate governance under responsibility and trust. Our strategic focus topics in the responsibility and trust dimension can be summarised as follows:

- Risk management: This addresses our ability to assess, manage, and minimise risks that could potentially impact the company’s position and development (see ESRS G1 Business conduct and ESRS 2 Company profile – Risk management and internal control system).

- Reporting and transparency: The focus here is on ensuring transparency in corporate communication as well as financial and non-financial reporting (see ESRS G1 Business conduct – Actions).

- Compliance and data protection: This topic covers the protection of data by the grenke Group and compliance with applicable laws and regulatory requirements (see ESRS G1 Business conduct – Strategic approach and objectives and key figures).

Strategic area of action Responsibility and Trust

Strategic target

TOP KPI

Action

Reference in the report

Increase identification with corporate strategy

Overall Strategy Awareness (Score)

Annual employee survey for identification of the employees with the strategy

Chapter ESRS G1 – Business conduct

Integrate ESG aspects into corporate management

Proportion of top management positions with variable remuneration containing a sustainability component

For the entire Group Management Board variable remuneration components are linked to sustainability targets

Chapter ESRS 2 and ESRS G1 – Business conduct

Strengthen internal controls and increase compliant behaviour

Completion rate of the internal audit reviews

Increase in actual vs planned number of audits completed by Internal Audit

Chapter ESRS G1 – Business conduct

Stakeholder dialogue

SBM-2 Stakeholders’ interests and positions :

Stakeholders’ interests and positions

We maintain an ongoing dialogue with our key stakeholders, particularly capital market participants, academia, authorities, associations, our employees, customers and partners. In the 2024 reporting year, we included nature as a “silent stakeholder”.

In view of the increasing importance of sustainability and its anchoring in our corporate strategy, these topics are an integral part of our stakeholder dialogue. We take our stakeholders’ feedback into account in our strategic decisions. We communicate with our stakeholders using various target group-specific communication formats and channels. The following table illustrates the different formats used for each stakeholder group:

Stakeholder

Formats, channels and frequency

Purpose/utilisation of results

Stakeholder internal

Management and employees

// Supervisory Board

// Board of Directors and top management

// Employees

Management meetings, CEO letter, ESG Committee, quarterly town hall meetings, regular employee information (intranet), annual employee survey, campaigns on occupational health and safety; social media (LinkedIn, Xing, Facebook), workshops and ESG projects, Sustainability Committee, ESG SharePoint, ESG newsroom, Sustainfluencer

Determining the impacts, risks and opportunities through surveys and risk inventory; utilisation in strategy and for CSRD implementation in the Group Sustainability Statement, collaboration and knowledge sharing

Stakeholder external

Business partners

// Lessees and customers

// Resellers for the Leasing segment and partners for the three business segments Leasing, Factoring and Banking

Visits and workshops, regular contact by phone, email and on-site appointments, welcome calls, customer loyalty measures, customer and partner magazine, satisfaction surveys

Further development of business relationships and customer loyalty, solution-driven adjustments to object and service offers

Capital market

// Investors (debt and equity)

// Banks/financial analysts

Annual reports, the Annual General Meeting, analyst and investor conferences, road shows and capital market conferences, ESG ratings (ISS ESG, S&P Global, Sustainalytics, MSCI, and EthiFinance)

Improvement and further development of relationships with analysts and investors

Supervisory authorities and regulators

// Regulatory authorities

// Regulators

// Auditing firms

// National/international legislators

(including standard setters)

Supervisory discussions, notifications and reporting, annual reports/other reporting, dialogue with development banks such as Kreditanstalt für Wiederaufbau for development programmes and the German Federal Ministry of Labor and Social Affairs regarding microcredits

Influence the design of the non-financial reporting, increase own transparency

Civil society

// Potential employees

// Media representatives

// Local stakeholders

// Non-profit institutions

// Associations

Social media presence on LinkedIn, Xing, Facebook and kununu, corporate reporting (press releases/guest articles), exchange with media representatives, customer and partner magazine, exchange in non-profit projects

Further development of corporate communications

Stakeholder silent

Nature & environment

Research results SBTi, CO2 balance according to Greenhouse Gas Protocol, 1.5 degree target UN/SDGs

Climate change mitigation, climate change adaptation through own business activities and organisation of the product portfolio, transition plan

As part of the quarterly report to the Board of Directors, the Board is informed about the results of the dialogues and perspectives of our internal and external stakeholders. The results are subsequently incorporated into the further development of the corporate strategy.

Partner survey

In 2024, we moved forward with the development of a global and comparable partner survey. The survey focuses on the topics of satisfaction, recommendation, image and the relevance of grenke as a partner. The target group for the survey includes both lessees (customers) and our specialist reseller partners. We summarise the survey results in the ESRS S4 Consumers and end-users – Strategic approach.

Exchange with public institutions, municipalities and social organisations

As a financial services provider for lease financing, our stakeholders also include customers from the public and social sectors. Here too, our aim is to provide our customers with easy access to financing. We report details on customer and partner loyalty in the chapter entitled ESRS S4 Consumers and end-users.

Sustainfluencer

We want to strengthen the dialogue with our internal stakeholders and promote innovative approaches and ideas at an international level. The Sustainfluencer format serves as an exchange to bring sustainability topics to the grenke countries and develop new ideas as part of a global internal ESG network. The first virtual Sustainfluencer meeting is scheduled for February 2025.

Double materiality assessment (DMA)

SBM-3:

Materials impacts, risks and opportunities in conjunction with strategy and business model

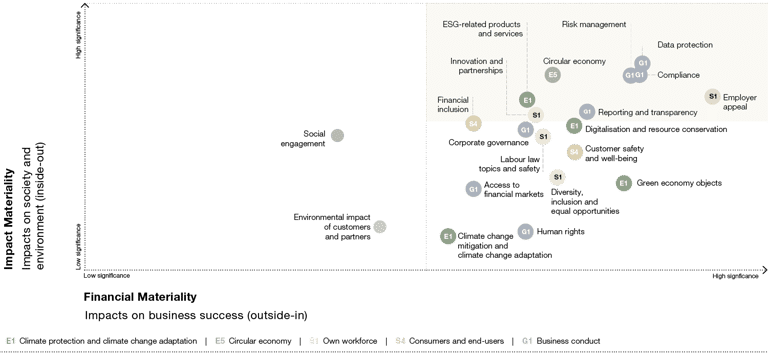

We organise our materiality analysis in accordance with the requirements of the double materiality principle in accordance with the European CSRD Directive and its ESRS reporting standards as well as national legislation in accordance with Section 289c (3) HGB. We consider sustainability issues from both an inside-out and an outside-in perspective. The inside-out perspective describes grenke’s impact on society and the environment, while the outside-in perspective looks at the impact of non-financial topics on the business performance, business results and position of the grenke Group (see the diagram “Materiality matrix”).

Our materiality analysis and the associated materiality matrix from 2022 form the basis for the material focus topics of our sustainability strategy (see ESRS 2 Sustainability strategy) and therefore also for this non-financial reporting. We update and review our materiality analysis annually. The process is relaunched at least every five years on the basis of a comprehensive survey of internal and external stakeholders. As part of the update in the 2024 financial year, we expanded the process to include an analysis of our positive and negative impacts, risks and opportunities (IROs) in accordance with ESRS (see the chapter ESRS 2 Sustainability strategy – Description of procedures for the identification and assessment of material impacts, risks and opportunities).

Materiality matrix

SBM-3: Material sustainability-related impacts, risks and opportunities

SBM-3: Material sustainability-related impacts, risks and opportunities

The following tables illustrate the sustainability-related impacts, risks and opportunities that were categorised as material as part of our double materiality assessment in 2024.

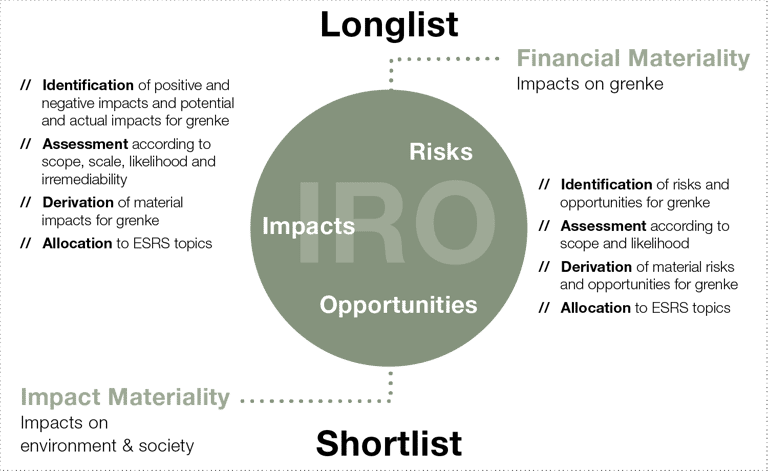

IRO-1: Description of the procedures for identifying and assessing the material impacts, risks and opportunities

The process for identifying our material impacts, risks and opportunities (IRO) comprises five key steps:

- Creation of the longlist: The ESRS topics5 potentially relevant to grenke were compiled based on the results of our materiality analysis from 2022 and 2023.

- Identification of potential impacts, risks and opportunities: Based on our strategic analyses, we identified potential short-, medium- and long-term impacts, risks and opportunities along grenke’s entire value chain. Impacts can be negative or positive and can include actual or potential impacts. According to our analyses, our business activities as a small-ticket leasing financier for SMEs do not give rise to an increased risk of negative impacts.

- Determination of the scale and threshold value: The scales defined in accordance with ESRS are used for the assessment. For the actual impact, we recorded the scope, scale and irremediability, while the probability of occurrence was also assessed for potential impacts. Risks and opportunities were assessed in terms of their potential financial impact on grenke and their probability of occurrence. The assessment is based on a scale of 1 to 4. The Company carrying out the assessment must only define the threshold above which an issue is categorised as material. grenke set this at 2.5.

- Materiality assessment of impacts, risks and opportunities: The materiality assessment was carried out via an online survey. This was sent to the Board of Directors, the Vice Presidents (first management level below the Board of Directors) and the Sustainability Committee. The internal stakeholders also act as liaisons and represent the interests of external stakeholders, based on findings and feedback from the ongoing dialogue with them (see chapter ESRS 2 Sustainability strategy – Stakeholder dialogue).

- Evaluation and acceptance of results: The results of the survey were analysed and the IROs identified as material were assigned to the corresponding ESRS topics. Topics above the threshold are material topics for grenke. The procedure and the results were then validated and approved by our Sustainability Committee and reported to the Board of Directors.

IRO assessment

List of disclosure requirements

IRO-26, MDR-M7, MDR-T8:

According to the results of our materiality analysis, five of the ten ESRS topic standards are material for grenke and decisive for reporting:

ESRS 2:

- Risk management

ESRS E1:

- ESG products and services

- Climate mitigation and adaptation

ESRS E5:

- Circular economy

ESRS S1:

- Employer desirability

- Labour law topics and safety

- Innovation and partnerships

ESRS S4:

- Customer satisfaction and safety

ESRS G1

- Human rights

- Compliance and data protection

- Reporting and transparency

- Access to financial markets

The following table provides an overview of the allocation of topics according to the structure under Section 289c HGB.

|

Environmental matters:

|

|

Workforce matters:

|

|

Social matters:

|

|

Respect for human rights:

|

|

Combating Bribery and corruption:

|

|

Sustainable business conduct:

|

In the following chapters, we explain the strategies, guidelines, measures, targets and metrics relating to our material sustainability topics. The measures described include those planned for the 2024 financial year and the future. The chapters also summarise the positive effects along the entire value chain and opportunities for grenke’s business model.

In this reporting year, we are utilising the phase-in regulation in accordance with ESRS for reporting on the financial impact of the individual material sustainability topics. This is particularly the case for the expected financial impact of material physical and transition risks and potential climate-related opportunities (E1-9), for example, in connection with resource utilisation and the circular economy (E5-6). We also apply the phase-in regulation to disclosures on people with disabilities (S1-12) and remuneration metrics (S1-16).

The disclosures in accordance with ESRS 2, E1, E5, S1, S4 and G1 are presented in a table at the end of the non-financial reporting. The disclosure requirements of the ESRS topic standards that are not classified as material are not included. We also supplement in Chapter 3.6 Appendices tables on our sustainability metrics and further references to additional disclosures under other EU directives.

Climate and Environment

We accelerate the transformation to a green future by providing sustainable financial services and facilitating green investment choices.